By single limited liability company is meant here a company that is not part of a larger company structure and that may only have one owner. The owner is typically also a private person (with possible elements of family). In these companies , the board meetings and general meetings are often characterized by being pure formalities. But formalities must also be taken care of, and preferably in as simple a way as possible.

On the platform, you can therefore have the board adopt the annual accounts and conduct the subsequent ordinary general meeting in minutes. And if you have registered any transactions in the shareholder’s book , you can automatically submit the shareholder register statement to the Swedish Tax Agency at no additional cost through our Altinn integration.

When we designed the dCompany platform, we naturally took into account that it should be extra fast for companies with little complexity. If any corporate law decisions are to be implemented, it is sufficient to indicate what is to be done and then it is possible to go straight to the signing without having to take a decision on questions that are only relevant where there are several shareholders.

The individual companies are often financed with contributions from the private person(s) who own the company. When it is time to get money back from the company, it is important to keep control of contributed capital so that distributions take place as repayment of contributed capital since this is usually tax-free rather than making a tax-related dividend with an associated tax liability for private individuals. And many are not aware that contributed capital follows the individual share, and not the shareholder, which can create complexity even for a company with only one shareholder.

And when the should an inheritance settlement take place, it provides security to hand over to a company where everything is in order. The heirs will also have access to what is the historical cost price of the shares since this is important for their own tax position.

dCompany assists individual companies with, among other things:

- Shareholder’s book: A user-friendly shareholder’s book that provides control over all history relating to the shares in the company, including historical cost price and paid-in capital per stock.

- Digital articles of association : Digital articles of association that ensure that everyone who works with the company always has access to the latest version, including any advisors who have been given access to the platform

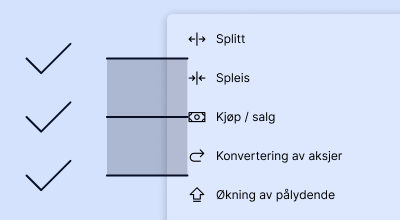

- dBot : Simple holding of an ordinary general meeting every year, and where all the documents are stored in the archive. Digitized and automatic processes for carrying out capital increases, capital reductions, conversion of shares and around twenty other company law processes.

- Shareholder register task : Submission of the shareholder register task directly from the platform through a few clicks and without the need to repeat information recorded when updating the shareholder register.

Time to follow up with owners in a better way?

With dCompany you give shareholders peace of mind and an overview

-

Contract note and share certificate

Both companies and individual shareholders can download share certificates and closing notes as confirmation of registered transactions. Very practical for companies with many shareholders.

-

dCompany shareholder book

Full control over shareholders, history and changes. Always updated overview of ownership. Supports all share classes.

-

General Assembly

Complete general meetings in minutes. dCompany automates convening, authorizations, registration of attendance, voting, protocol and signing.

-

Shareholder pages

Make shareholders self-service with individual shareholder pages The shareholder pages give each shareholder a full overview of their own shares, […]

-

Shareholder register statement

With dCompany’s shareholder book, you can deliver the shareholder register statement directly to Altinn and the Tax Agency with a few simple keystrokes.

-

Transactions

dCompany allows you to register most forms of transactions on the platform, such as the transfer of shares by purchase/sale, inheritance or gift.

Very time-saving.

dCompany is very responsive to feedback and has a customer focus in development.

The service has a user interface that does not require training to be used.

Petter Reistad

CEO

Celsius