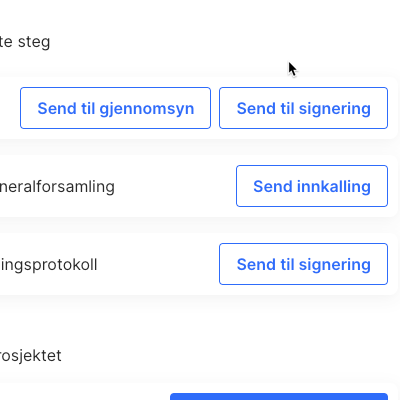

Fast and correct process for dividend payment, including automatic generation of notices and minutes, sending and signing, and registration in the transaction log in the shareholder book

Formal process

The dividend is decided by the general meeting within the framework of the board’s proposal.

Dividends are decided by the general meeting, cf. Section 8-2 (1) of the Companies Act. It cannot be decided to distribute a higher dividend than the board has proposed or accepts. It is therefore important that there is a board protocol that proposes a dividend that is at least as high as that approved by the general meeting.

The general meeting can authorize the board to decide on dividends

The general meeting can, after it has approved the annual accounts for the last financial year, authorize the board to decide on the distribution of dividends on the basis of the company’s annual accounts, cf. Section 8-2 (2) of the Companies Act. The power of attorney cannot apply for a longer period of time than until the next ordinary general meeting.

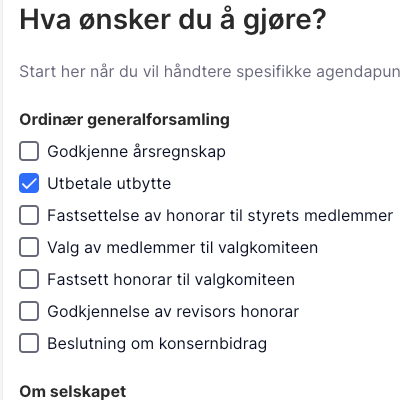

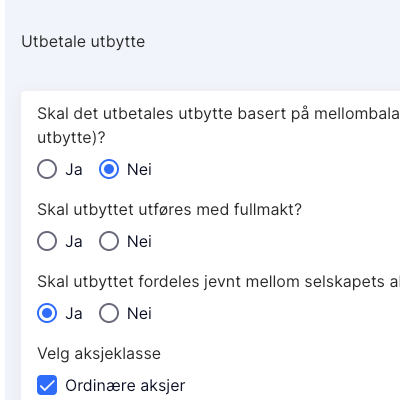

Election for dividends

- State whether the dividend is based on the interim balance sheet or the latest annual accounts

- State whether the dividend takes place pursuant to authorization from the general meeting

- Specify whether the dividend is to be distributed equally (equal amount for each share in the same share class) or distributed unequally

- For equal dividends

- Select the share class the dividend is to be paid on and possibly amount per share or total amount

- Enter the time at which you must be a shareholder to be entitled to dividends

- For lopsided dividends: indicate who will receive dividends, on which shares and with what amount

- State whether the dividend is to be considered repayment of capital or not

Follow-up

The dividend shall not be registered in the Brønnøysund registers. However, it should register it in dCompany’s transaction log , so that you have the history for later and for it to be taken into account automatically in the shareholder register statement .

Good to know

- You can register dividends both as a total amount and as an amount per stock

- You can register both equal and unequal dividends

- You can specify whether the dividend is to be considered repayment of paid-in capital (as far as such exists)

- The decision on dividends is integrated with the transaction log in the shareholder book so that you can easily record it

- The dividend is registered on the individual person and – if it is to be regarded as repayment of paid-in capital – on the individual share identified by share number

- If you have registered the dividend in the transaction log, the dividend will automatically be reflected in the draft shareholder register statement

Combine events

With dBot you can combine free text and automated company events in the same formal process

Norwegian and English

Choose between Norwegian, English or bilingual documents